4 US Staffing Industry Updates for Q2 2022 [Infographic]

The US staffing industry has remained an attractive growth avenue for international recruiters to explore by placing contractors with their US clients. This blog and infographic will provide you with an update on how the US staffing market performed from April – June 2022 (Quarter 2 – Q2) based on research from Staffing Industry Analysts (SIA) and the American Staffing Association (ASA).

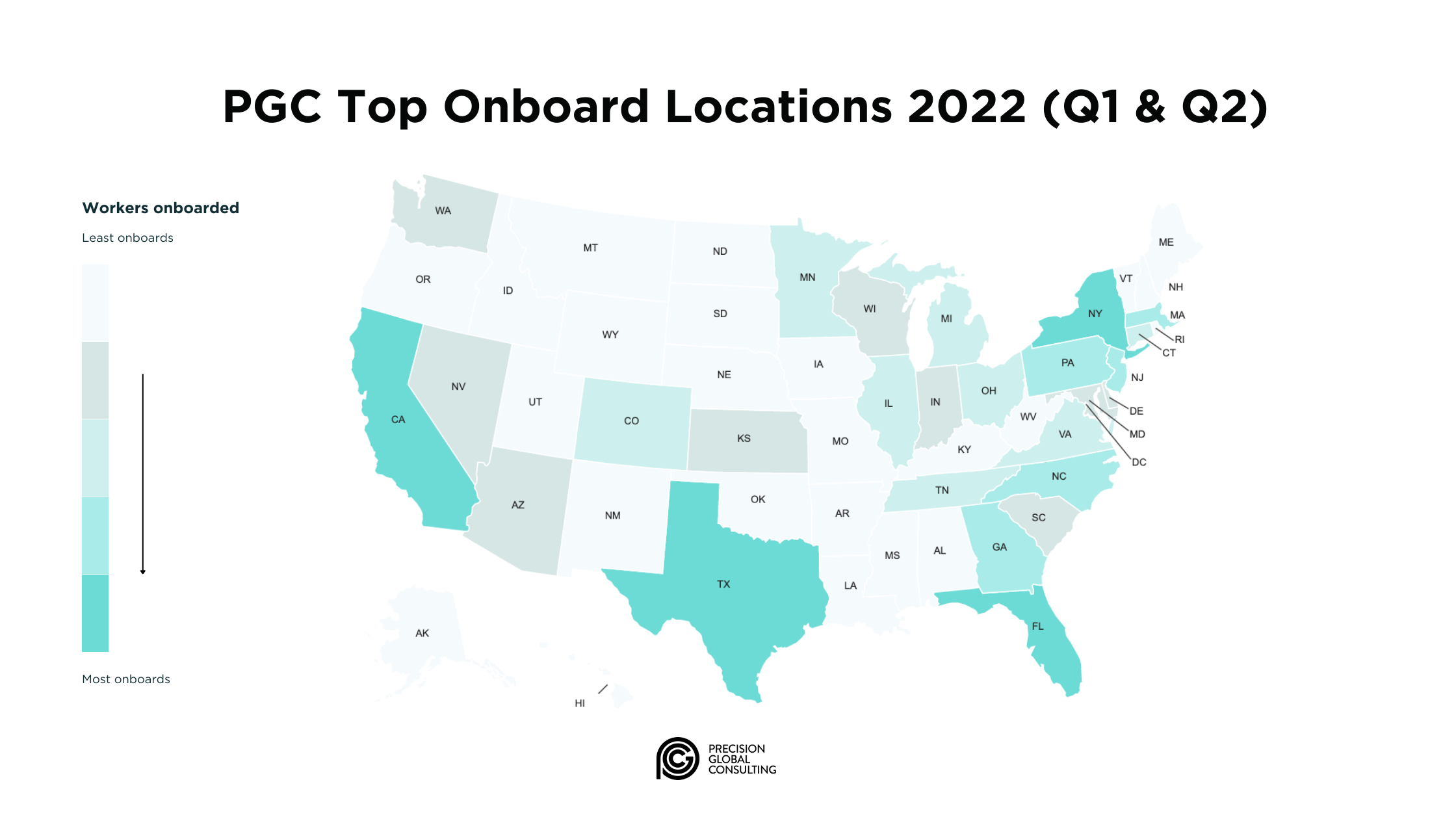

As a bonus, we will also be sharing PGC internal data on the most popular states for contract placements based on our international recruitment client's worker onboards for the first half of 2022.

1) US Staffing Industry Revenue Projections for 2022 Revised Upwards

According to the new US Staffing Industry Forecast report released by Staffing Industry Analysts in May 2022; the US staffing industry is projected to generate a record $185.5 billion in revenue in 2022, exceeding previous projections.

Considering the US staffing industry was worth $152.8 billion in 2019, pre-COVID, this significant jump in revenue highlights the demand for recruiters in the US which cannot be contributed to the bounce back after the pandemic alone.

The record number of job openings in the US in 2021 and 2022, wage inflation, and advancements in technology for hiring processes have all driven the surge in the market. Sustaining its reign on the staffing market, IT temporary staffing is expected to achieve the highest revenue growth in 2022. This comes as no surprise, as throughout each month in 2022 to date, the IT temporary staffing skill segment continued to perform exceptionally well in the US.

If you are a recruiter operating in the US staffing market, focusing on a skill segment like IT which has a positive track record with predictions to grow even further could be an opportunity worth seizing.

2) Positive US Labor Performance During Q2 2022 Reflects the US Staffing Industry

Reviewing the recent performance of the US labor market is often a good indicator of the state of the US staffing industry, as the number of available jobs and job seekers reflects the demand for recruiters to help fill vacancies. Let’s go through the performance of the US labor market during the second quarter (Q2) of 2022.

April 2022 US labor market performance

The change in total nonfarm payroll employment for April was +368,000 jobs year-over-year (y/y) according to the Bureau of Labor Statistics (BLS). For April 20222, Nevada, Texas, Georgia, and Florida experienced the largest y/y growth in employment. Specifically, Nevada accomplished a 7.13% y/y increase. Coincidently, these states have also proved popular with PGC recruitment clients making placements throughout the US, with both Georgia and Florida emerging from our internal data as states with the strongest y/y growth so far in 2022.

May 2022 US labor market performance

US job growth exceeded economic predictions in May 2022 after an additional +384,000 jobs were added y/y. Temporary help jobs totaled nearly 3.4 million in May, having expanded by 339,00 y/y according to the BLS. In addition, the American Staffing Association (ASA) also recorded an 11.8% y/y increase in temporary and contract employment in May. Increases in temporary employment demand often translate to a higher demand for staffing agencies.

June 2022 US labor market performance

The outlook for the US staffing industry remained positive in June 2022 as employment growth resumed. The BLS recorded an increase of +327,000 total nonfarm jobs y/y in June on a seasonally adjusted basis. The US unemployment rate remained stable at 3.6%, edging closer to the pre-pandemic historically low level of 3.5%.

Data released by the American Staffing Association (ASA) in June found that US staffing sales reached $37.4 billion in Q1, a new first-quarter high. Additionally, ASA found that US staffing companies employed an average of a 2.7million temporary and contract workers per week in the first quarter of 2022. A 10.8% y/y increase when compared with the first quarter of 2021.

3) More International Recruiters are Placing Contract Talent in Tennessee

Here at PGC, we have witnessed several trends from our 2022 data to date across our clients and workforce. As an employer of record, we help international recruitment companies easily make contract placements across the US by handling all the payroll and employment compliance. The map below shows the popular states for contract placements during the first half of 2022, which will give you an idea of where to source remote talent from or pursue US clients.

It's no surprise, that like 2020 California, Texas, and New York have continued to be the top destinations for our client's contract placements in the US so far in 2022. In comparison to 2021:

Texas has overtaken New York as the second most popular state for recruiting.

Florida has replaced New Jersey as the fourth most popular onboard location in the US.

Tennessee soared to the 11th most popular state in 2022 for contract placements, from number 20, in 2021. We believe this is a state to watch out for as since January 2021, personal income tax no longer existed in Tennessee. Consequently, the state is attracting high-quality workers from this change.

4) Recruiters Should be Aware of the Increasing Number of States Requiring Salary Transparency

The New York City Salary Transparency Law was set to take effect on May 15, 2022, but, on April 28, 2022, the New York City Council passed an Amendment to Local Law 32 that pushed the effective date of the law back to November 1, 2022.

If you are actively recruiting in New York City, from November 1, you will have to include a minimum and maximum salary (base rate of pay) for every job, promotion, and transfer opportunity advertised in NYC. New York will be joining the following states where recruiters currently must display the salary ranges for positions:

California

Colorado

Connecticut

Maryland

Nevada

Rhode Island

Washington

It is becoming clear that pay transparency is becoming a trend in the US in 2022, not only legally in some states, but as a deal breaker for candidates before they make their final decision on whether to accept or even apply for a role in a labor driven market. Especially when inflation has continued to creep up, more and more recruiters are choosing to display salary ranges to attract high-quality talent.

Considering Entering the US Staffing Industry?

The US staffing industry has held its powerful position as the number one area globally for staffing revenue. Both job numbers and revenue projections increased yearly, proving the demand for recruiters in the US is still strong. However, recruiters need to be mindful of rising interest rates, inflation, and wage transparency laws, which may affect recruitment practices.

If you’re intrigued by the opportunities the US staffing market presents, a free US consultation with PGC will talk you through how you can easily start placing contractors anywhere in the US with PGC’s employer of record solution.