Why Incorporate in Delaware? The Pros and Cons [Infographic]

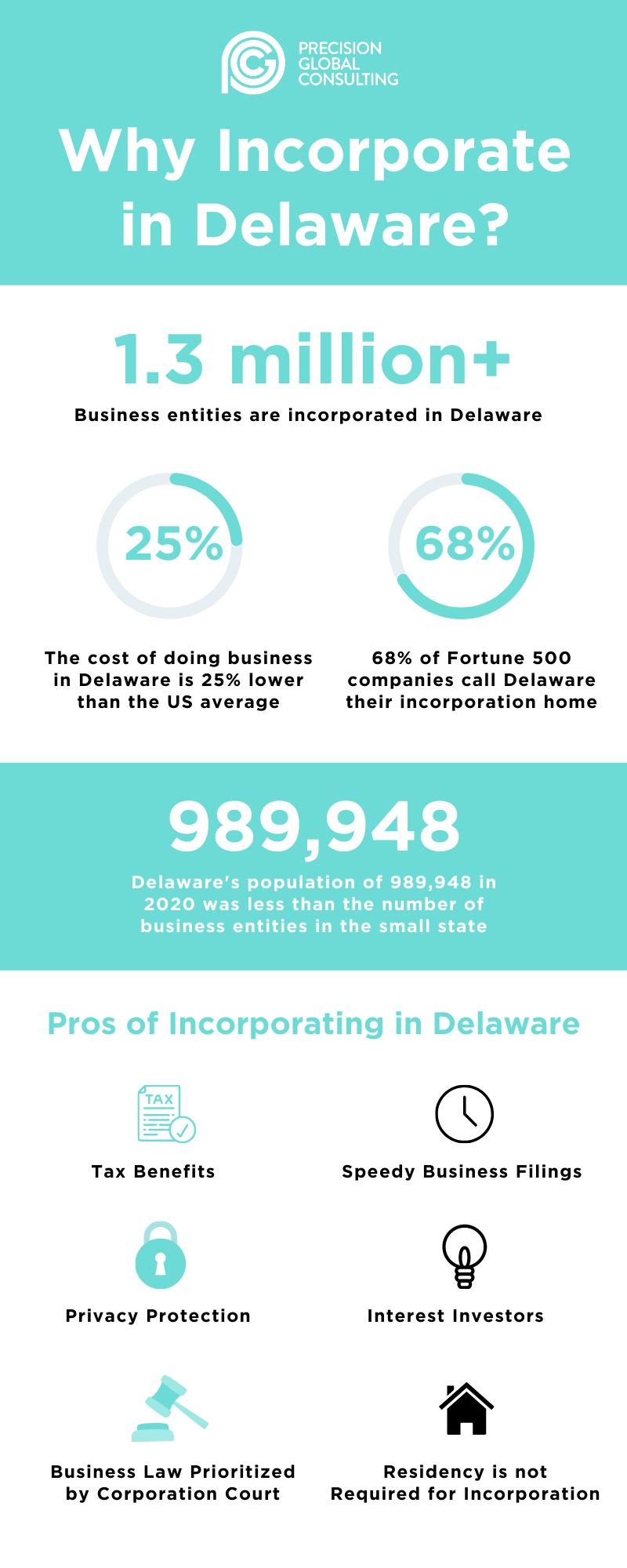

Over 50% of publicly-traded companies in the US choose to incorporate their business in Delaware, the home of over 1.3 million business entities. This growing number of business entities that incorporate in Delaware is more than the small state’s population of 989,948 in 2020. Why are so many companies incorporated in Delaware? Let’s find out why by going through the pros and cons of incorporating in Delaware.

Pros of Incorporating in Delaware

1) Tax benefits in Delaware

Delaware is famed for its lenient tax system, boasting a 25% lower cost of doing business than the US average. One of the main reasons why so many companies are incorporated in Delaware is because they do not have to physically do business in the state to make use of the no corporate income tax incentive. If a business decides to incorporate in Delaware, the tax benefits they can utilize include:

No corporate income tax (pending corporate income tax exemptions, see below)

No state or local sales tax

No investment income taxes

No personal property taxes

No inheritance taxes.

Delaware corporate income tax exemption

The general corporate income tax in Delaware is 8.7%, however, there is a loophole. According to the Delaware code, corporations are exempt from paying corporate income tax in the state if the “corporations whose activities within the state are confined to the maintenance and management of their intangible investment, as well as the collection and the distribution of the income from such investments.”

Additionally, a “statutory corporate office (registered office) in the State but not doing business within the state” does not have to pay corporate income tax. This explains why so many companies are incorporated in Delaware. These tax benefits in Delaware come at a small price in the form of franchise tax, which we will go over in the disadvantages section.

2) Expedite Business Filings

The speedy incorporation process is where Delaware really shines, offering same-day business fillings which often only take one hour to complete.

3) Privacy Protection

The anonymity of persons of authority is guaranteed when you make business filings in Delaware. Delaware law only allows one person to hold numerous positions in a company. This means Directors’, officers’, and shareholders’ names do not need to be disclosed to the state. In other states, naming just one person of authority is only achievable with LLCs or sole proprietors. Delaware’s leaner corporate structure requirements are particularly attractive to small businesses when incorporating.

4) Business Law Prioritized by a Dedicated Corporation Court

Delaware’s reputation for being corporation-friendly stems from the favorable business laws the state offers. The state has a dedicated corporation court named the Court of Chancery, which is a court of judges who specialize in corporate law.

When businesses are selecting a state to incorporate in, their choice determines who governs their internal affairs. By choosing Delaware, they are guaranteed advanced and predictable business laws. The specialized court and use of judges over juries allows the state to prioritize and resolve corporate lawsuits quicker than the lengthy trial systems present in other states.

5) Investors Prefer Delaware Corporations

If a business is a startup that anticipates needing help to scale with outside investors' help, angel investors and venture capital firms often prefer companies that are incorporated in Delaware. A large volume of corporate cases is held at the Court of Chancery in Delaware. This has built case studies of legal decisions over time which has created more predictable outcomes. This foreseeable nature of legal decisions is attractive to investors who have become comfortable with the state’s law.

6) Residency is not Required for Incorporation

Neither US citizenship nor residency is required when forming a corporation in Delaware. This is a huge plus for international businesses expanding to the US that might not be ready to have a physical presence. Officers, directors, and shareholders do not need to be Delaware residents and can be based anywhere in the world if they choose to incorporate in Delaware.

7) Join the Fortune 500 Companies Incorporated in Delaware

According to the Delaware Division of Corporations, 67.8% of Fortune 500 companies are incorporated in Delaware. Facebook, Google, Morgan Stanely, Verizon, and Walt Disney are a few of the many global giants incorporated in Delaware. Interestingly, most of these companies have an identical Delaware address for their official legal documents. A nondescript office in Wilmington is the official incorporation address of nearly 300,000 companies. Delaware has established itself as the go-to destination for incorporation for many big companies, proving it is a trialed and successful method.

Disadvantages of Incorporating in Delaware

1) A Price to pay for Tax Benefits

The tax benefits in Delaware come at a small price. To register in Delaware, businesses must pay an annual franchise tax for the privilege. This is based on the number of authorized shares within the corporation, so as share value goes up, the amount of franchise tax increases. However, the general price of franchise tax is minimal in comparison to income tax charged in other states.

2) Filing fees in Delaware

Despite boasting the fastest turnaround time to file a business in the US, the filing process comes with a catch. Delaware’s filing fees can end up being significantly higher than other states. The initial filing fee for a domestic corporation in Delaware is $89 and $245 for a foreign corporation.

Additional filing fees that may cause this price to climb:

Name reservation

Registered agency designation

Filing an annual report

Franchise tax.

Certified Copy of the incorporation or formation documents

When you compare this to the likes of Florida, which charges a $35 filing fee for both domestic and foreign corporations, the overall filing costs in Delaware can become expensive.

3) Businesses Must Follow State Requirements Outside of Delaware

Many businesses incorporate in Delaware but conduct business in another state. When conducting business in another state, the corporation still needs to meet that state’s filing and licensing requirements, including providing an annual report. This can result in double the end-of-year work and expenses, which is one of the main disadvantages when incorporating in Delaware.

Out-of-state tax

A business’s home state may also charge an out-of-state business tax which on top of Delaware’s franchise tax, can off-balance any tax savings they achieve. For example, under California law, if a company is doing business in California, but incorporated in Delaware, it must pay an $800 annual franchise tax even if they are not registered in the state.

4) Businesses Need a Registered Agent in Delaware

When you file business in Delaware, a registered agent’s name is required who can accept legal filings on your behalf. For businesses operating outside of the state, being present in the state can become tricky, and they may need to hire a registered agent to be their official business contact. Registered agent services costs can range from $50 to over $300 per year.

5) Legal Disputes Must Take Place in Delaware

Sure, Delawares specialized corporate court speeds up company legal disputes, but these cases must be heard in person. With company lawsuits being all too common in the US, this can become a headache, especially for small companies that need to travel to Delaware to handle any legal disputes. A Delaware attorney is also required, which is another hidden extra cost.

Ready to Incorporate in Delaware? Align Your Business Objectives First

Delaware offers a host of business-friendly benefits companies can leverage by incorporating in the state. It is important to note that Delaware’s popularity with fortune 500 companies comes down to their ability to afford the additional costs of incorporating in the state. The regular travel for legal disputes and additional hidden filing costs is inexpensive in comparison to these big companies' lucrative profits but often may outweigh the tax-saving benefits for small businesses.

The decision on where to incorporate largely depends on your business objectives. The Secretary of State Office and Websites is a good starting point to figure out the best-matched state requirements for your business.

Here at PGC, we’ve been helping international companies expand to the US for over 20 years; removing the barriers of engaging workers with our employer of record solution. Over this time, we have built up partnerships with experts who support companies expanding to the US, and will happily signpost you to the right expert for advice on incorporation.

Disclaimer: All information written here is for general informational purposes only and is not intended to be a substitute for professional and/or legal services.