US Employment Law 2023 Updates

Over the last year, the United States has continued to adapt itself to the ‘new normal’ in a post-Covid world. From an employment law perspective, the country experienced significant changes and growing trends in 2022.

As always, PGC is here to help guide you through the ever-evolving landscape that is US employment law with our latest round of updates for 2023, ensuring that you and your business is prepared for these changes and their impacts.

Paid Sick Leave

Although there is no federal requirement for businesses to offer paid sick leave to their employees, many states have their own laws regarding this matter.

PGC clients can refer to our updated Paid Sick Leave Guide, which provides a list of states and localities where paid sick leave is required in 2023. Please reach out to your dedicated Business Manager for further guidance.

Overtime Exemption Salary Threshold Updates

Under the federal Fair Labor Standards Act, employees generally must be paid a minimum salary of $684 weekly, or $35,568 annually, to be classified as exempt from overtime, with limited exceptions. Though the Biden administration has hinted at an increased salary level threshold for white-collar exemptions, and the U.S. Department of Labor had projected it would issue a proposal in October, no such proposal has been published as of writing. PGC is staying on top of any updates and all clients will be notified of any federal overtime changes if, and as soon as, they are released to the public.

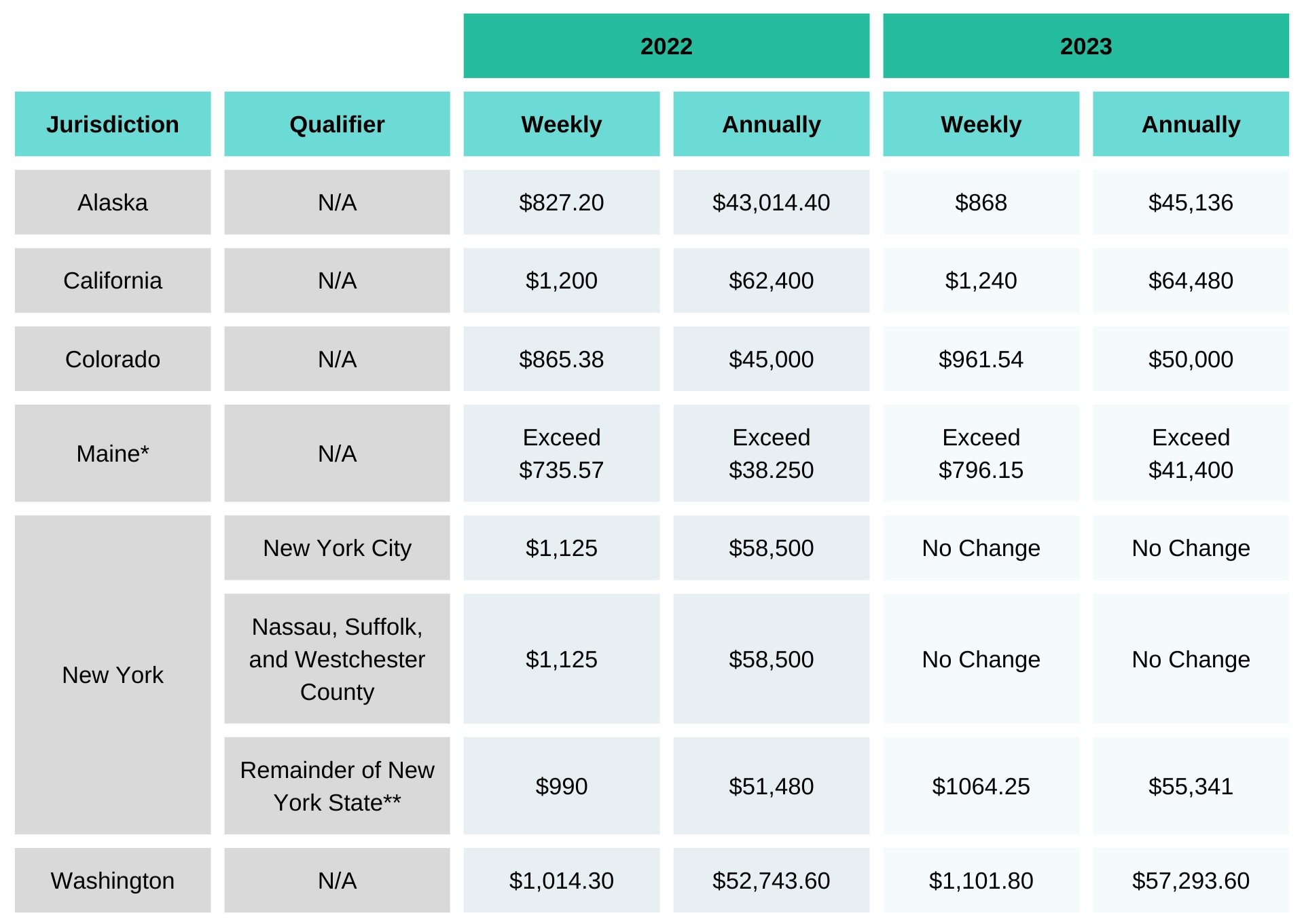

In the meantime, the following states and localities have adjusted their minimum exemption salary thresholds:

*The salary must exceed 3,000x Maine’s minimum hourly wage or the annualized rate established by the Department of Labor, whichever is higher. While Maine has not announced its updated minimum salary exemption threshold for 2023, the state’s minimum wage is set to increase from $12.75 per hour to $13.80 per hour.

**The amount indicated for 2023 has been proposed and is likely to be finalized through the appropriate legislation.

Computer Employee Exemption

To be classified as exempt from overtime, the federal hourly rate for employees in a computer-related occupation is $27.63 hourly or $684 weekly.

The following states have adjusted their minimum salary exemption requirement for computer employees:

California: $53.80 hourly, or $112,065.20 annually

Colorado: $31.41 hourly (This amount has been proposed and is likely to be finalized through the appropriate legislation)

401(k) Updates

The federal ‘highly compensated’ threshold will increase from $135,000 to $150,000. This means that any workers who have earned $150,000 or more through PGC in 2022 will no longer be able to contribute to our 401(k) in 2023. Any impacted workers will be notified by PGC prior to the end of the year.

There are also changes to both the Traditional 401(k) and the Roth 401(k), discussed below.

Traditional 401(k)

In 2023, employee contributions will cap at $22,500 – a $2,000 increase from 2022. The catch-up deposits for individuals aged 50 and older will increase from $6,500 to $7,500.

Roth 401(k)

The maximum yearly contribution for a Roth 401(k) will increase from $6,000 to $6,500. The IRA catch-up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and remains $1,000.

Health Savings Account (HSA) Contributions Update

The annual federal inflation-adjusted limit on HSA contributions for self-only coverage will increase from $3,650 to $3,850. The HSA contribution limit for family coverage will increase from $7,300 to $7,750. If your workers elect a qualifying medical plan, this is a pre-tax benefit as your workers can defer income pre-tax into this account reducing their taxable income for the year while putting aside pre-tax dollars for any qualified health and wellness costs.

State-by-State Legislative Updates

PGC has compiled the following list of employment laws that have either taken effect in the second half of 2022 or are set to take effect in 2023. Please reach out to your PGC Business Manager for further guidance!

-

California Privacy Rights Act (amending the California Consumer Privacy Act)

What does it mean for employers?

Under the Consumer Privacy Act, exempted employers maintaining employee’s personally identifiable information in an employment context, including applicants in the hiring process, were exempt from the Act’s obligations. This exemption will expire on January 1, 2023 and information collected as part of the hiring process will now be covered by the act as well

Covered businesses must provide a detailed privacy policy, at the time of collection, about how the business handles the personal information and sensitive personal information of employees and job applicants.

When does it take effect?

January 1, 2023,

California’s Family Rights Act (Bereavement Leave)

What does it mean for employers?

The amendment provides covered employees with bereavement leave upon the death of a family member. Covered employees are permitted to take up to five days of leave within three months of the death of a family member. The leave must be taken pursuant to the employer’s existing bereavement leave policy; in the absence of a policy, the leave may be unpaid. The employer may request documentation of the death within 30 days of the first day of leave.

When does it take effect?

January 1, 2023,

-

Juvenile Records in Background Checks

What does it mean for employers?

Employers in Colorado are prohibited from requiring an applicant to disclose information related to juvenile court records. Please keep this in mind if you are running any background checks on workers that are located in Colorado.

When does it take effect?

August 9, 2022.

-

Ban on Non-Compete Agreement Act

What does it mean for employers?

Employers are prohibited from requiring or requesting that certain employees performing work in Washington D.C. sign an agreement that includes a non-compete provision.

When does it take effect?

October 1, 2022.

Universal Paid Leave (Washington D.C)

What does it mean for employers?

The District’s Universal Paid Leave Act was amended to expand the amount of leave available for eligible employees from 6-8 weeks of prenatal, family, and medical leave to 12 weeks. This leave is paid by the District not the employer however it is important to note that the worker’s role will be job protected while they are out on this leave.

When does it take effect?

October 1, 2022.

-

Bereavement Leave for Child Loss

What does it mean for employers?

The law requires covered employers to provide up to 10 days of unpaid leave for reasons including, but not limited to, miscarriage, failed adoption match, a diagnosis that negatively impacts pregnancy or fertility, and stillbirth. Eligibility and coverage are determined in the same manner as federal Family Medical Leave Act (FMLA) eligibility. It is important to note that although the leave is unpaid, workers out on this leave will be job-protected during this time.

When does it take effect?

January 1, 2023.

One Day Rest in Seven Act (ODRISA)

What does it mean for employers?

ODRISA has been amended updating hours of rest provisions and meal break requirements. Non-exempt employees must be provided one day of rest in every consecutive seven-day period, rather than every calendar week as the Act originally required.

Under ODRISA, employees who work 7.5 continuous hours are entitled to an unpaid 20-minute meal break within the first five hours of work. The amendment adds that employees who work in excess of 7.5 consecutive hours are entitled to an additional 20-minute meal period for every additional 4.5 consecutive hours worked.

When does it take effect?

January 1, 2023.

-

Vacation Pay and Final Wages

What does it mean for employers?

Maine has enacted “An Act Regarding the Treatment of Vacation Time upon the Cessation of Employment”. The act requires employers with 11 or more employees in Maine to pay all accrued vacation pay at the time of separation, no later than the employee’s next payday.

When does it take effect?

January 1, 2023.

-

Automated Employment Decision Tools

What does it mean for employers?

Employers using an automated employment decision tool to screen candidates for an employment decision are required to notify each candidate regarding the use of the AI tool.

An “automated employment decision tool” encompasses any process that uses machine learning, statistical classification, or recommendation, and that is used to substantially assist human discretion in screening candidates for employment or promotion within New York City. The law applies to employers and employment agencies, and requires that any such tool undergo an annual, independent bias audit with a publicly available summary. Employers and employment agencies must provide each candidate with 10 business days’ notice prior to being subject to the tool. Candidates must be able to opt-out and request an alternative selection process or accommodation.

When does it take effect?

January 1, 2023.

-

Anti-Retaliation Protections

What does it mean for employers?

New York State has amended its anti-retaliation protections to clarify that employers are prohibited from punishing or disciplining employees for using any legally protected absences provided by any state, local, or federal law, effective February 19, 2023.

Specifically, employers are prohibited from assessing points, demerits, or occurrences; deducting from an allotted bank of time which would subject an employee to disciplinary action; and failing to promote or subjecting the employee to a loss of pay due to the legally protected absence.

When does it take effect?

February 19, 2023.

-

Wage Discrimination

What does it mean for employers?

Employers are prohibited from paying any of their employees at a wage rate less than the rate paid to employees of another race, color, religion, sex, sexual orientation, gender identity or expression, disability, age, or country of origin for comparable work. “Comparable work” means work that requires substantially similar skill, effort, and responsibility, performed under similar working conditions.

When does it take effect?

January 1, 2023.

Salary History Ban

What does it mean for employers?

Employers may not rely on the wage history of an applicant when considering the applicant for employment. Employers may not seek the wage history of an applicant. This is similar to laws that we already see in effect in New York, Ohio, Colorado and California.

When does it take effect?

January 1, 2023.

Pay Range Disclosure

What does it mean for employers?

Upon an applicant’s request, an employer must provide an applicant with the wage range for the position for which the applicant is seeking and should provide the wage range before discussing compensation.

When does it take effect?

January 1, 2023.

-

Pay Range Transparency

What does it mean for employers?

Employers with 15 or more employees must disclose the wage scale or salary range, and a general description of benefits in postings for job openings. A posting means any solicitation intended to recruit job applicants, including recruitment done directly by an employer or indirectly through a third party. This is similar to requirements that are already in place in New York, California, and Colorado.

When does it take effect?

January 1, 2023.

Any Questions on US Employment Law 2023 Updates?

Trying to get to grips with employment compliance in North America can be a real headache. We get it.

As the longest-serving employer of record exclusive to the North American market, we’ve been a trusted partner for businesses from all around the globe; removing the barriers and complexity of engaging workers across the US and Canada.

We ensure full regulatory compliance and manage onboarding, payroll, expenses, insurance, and benefits, so you don’t have to. Speak to one of our specialist expansion consultants to see how we can help your business.

Disclaimer: The information provided here does not, and is not intended to, constitute legal advice. Instead, the information and content available are for general informational purposes only.