What’s Been Happening in the US Staffing Industry 2021 [Infographic]

If you want to excel and grow in the US staffing industry it is important to keep on top of the latest insights to seize opportunities and inform strategic decisions to benefit your business. The US staffing industry moves fast, which is why we frequently share industry staffing stats with our clients to help them to keep a pulse on the market. The infographic below contains a few of the main takeaways from our client exclusive quarterly North American Staffing Roundups.

Looking at the overall US landscape and the economy is a big indicator to help predictions on the US staffing industry’s future performance. Real GDP increased in all 50 states and for the nation at an annual rate of 4.3% in the 4th quarter of 2020.

The finance and insurance industry contributed significantly to the overall real GDP increase, signifying growing industries with further job demand expected. According to the Bureau of Economic Analysis’ advanced estimates, real gross domestic product (GDP) is estimated to have increased 6.3% in the first quarter of 2021 and 6.5% in the second quarter.

US Unemployment Rates are Decreasing

The US unemployment rate has steadily declined month to month from January 2021 (6.3%) to May (5.8%), only rising by a small 0.1% in June to a total of 5.9%. Interestingly in May, 27 states reported lower unemployment rates than the US national rate of 5.8%. New Hampshire had the lowest jobless rates in May at 2.5%, closely followed by Nebraska and Vermont at 2.6% each.

Furthermore, May was the second consecutive month of record-breaking job openings in the US during 2021. According to the US Bureau of Labor Statistics, US job openings increased in May by 16,000 to a total of 9.2 million. This is the highest since records began in December 2000, meaning the opportunity to recruit in the US has never been greater.

Overall, the increase in US GDP and declining unemployment rates reflects the continued economic recovery from the sharp declines in early 2020 from the ongoing impact of the COVID-19 pandemic.

US Staffing Market Size

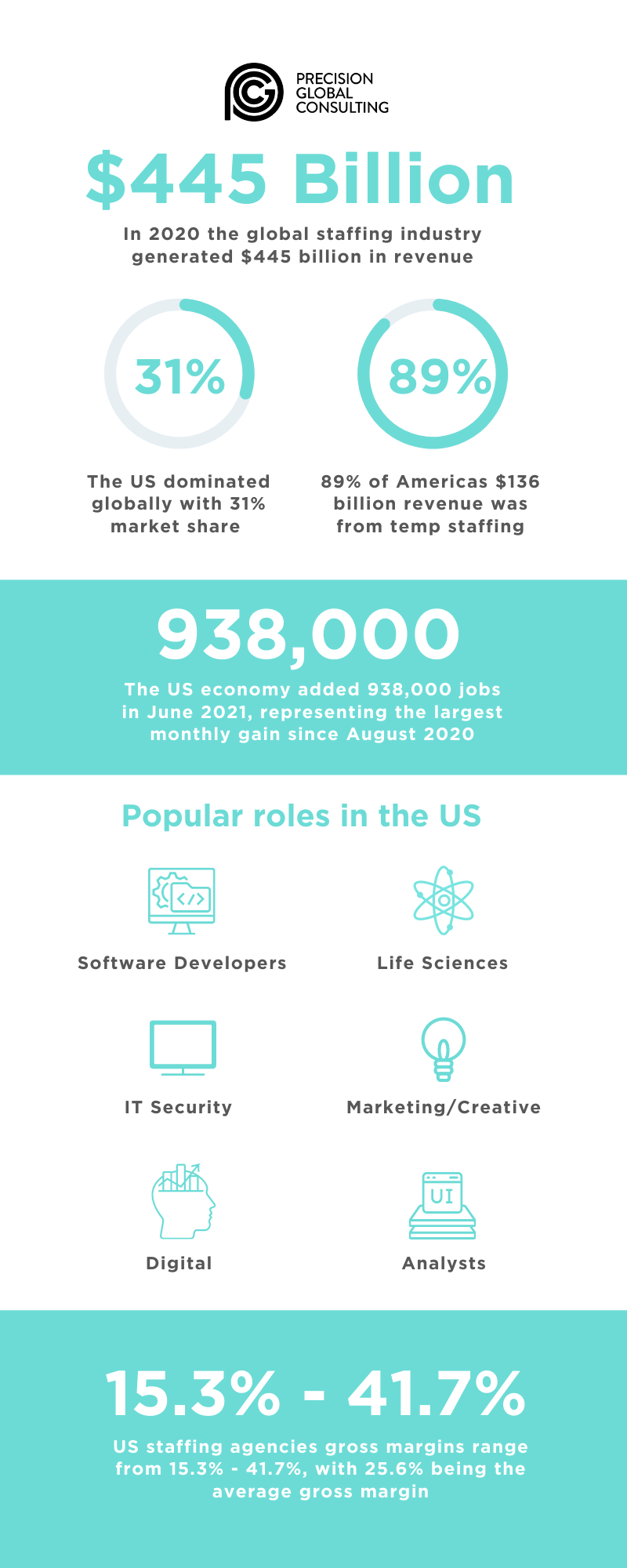

The US staffing market is the largest in the world, accounting for a huge 31% of global staffing revenue in 2020 and number one amongst the three countries that hold 55% of the industry’s $445 billion global revenue.

Staffing revenue in the Americas (North and South America) totaled $152 billion in 2020. Temporary staffing accounting for 89% of this entire revenue according to SIA's Global Staffing Market Estimates & Forecasts released in May 2021.

Considering the US staffing market size and the fact that alone states like California have a larger economic output than the whole of the UK, the potential for international recruitment agencies to grow by making placements in the US is enormous.

Contract Roles are in Demand

The steady return to normalized business operations, vaccination rollout, improved market confidence and greater demand for staff have all driven increased recruitment activity in the US in Q2 2021. Temporary roles have been expanding, with the temporary penetration rate (temporary jobs through a staffing firm as a percent of total employment), hitting the highest level in February 2021 since January 2020 at 1.94%. The temporary penetration rate in the US continued to increase until March, before dipping to 1.84% in April and remaining relatively unchanged since, at 1.83% at the time of writing in July.

US Talent Shortage Presents an Opportunity for Recruiters in the US Staffing Industry

The US Chamber of Commerce declared the talent shortage as an urgent workforce crisis in June 2021. There are now half as many available workers for every open job across the US as there have been on average over the past 20 years.

Unemployment benefits are still available in many states, which has resulted in many Americans who lost their job during the pandemic remaining hesitant about returning to the labor market. The threat of new COVID-19 variants also has made those currently in positions less likely to be open to switching jobs.

These underline issues have made it challenging for companies to attract high-quality talent and complex the hiring process. However, the high demand for talent can be seized as an opportunity for US staffing firms as many managers are now seeking help from specialized staffing agencies to secure skilled professionals, especially within IT.

Fastest Growing Job Sectors in the US

If you are considering entering the US staffing industry it is important to conduct market research to uncover the popular staffing roles in the US. Alternatively, if you are already making placements within the US, you should consider the following roles as new verticals to explore as they grow in demand.

IT

One sector which has continued to constantly grow throughout 2020 and 2021 is IT. Companies are still seeking experts to help them securely function in a remote working world. IT employment hit pre-pandemic levels in April 2021, adding 45,200 jobs to total more than 5.3 million jobs. With IT making up the largest share of professional staffing revenue in the US, this is an area ambitious international recruiters should consider exploring to increase their staffing revenue.

Marketing/creative

The marketing and creative temporary staffing skill segment has also continued to grow each month in 2021. This professional staffing segment experienced the largest increase in revenue from surveyed staffing firms by SIA in June 2021, up 23% year over year in June 2021. As companies in the US continue to embrace digital trends to stand out online, marketing and creative professionals are desired talent, and staffing agencies can help companies source high quality talent.

Life Sciences

In the back of the COVID-19 pandemic, the life sciences sector has been crying out for talent and is a sector that has increasingly grown over the last few years. Competition among employers to replace retirees in this field has upped the wages and made it an attractive and popular sector for staffing agencies to recruit in.

Clean Energy

Another sector worth noting in the US is energy, particularly clean energy. More investment from the US government is expected to be pumped into the energy sector, especially in light of recent climate issues. This paves the way for recruiters who specialize in the energy market to seize opportunities in this growing US sector.

US Pay Growth Continues to Accelerate

A sharp rebound in labor demand, paired with unemployment benefits still being readily available in the US has led to a notable fall in the supply of workers. Consequently, this has led to rapid increases in both starting salaries and temporary pay. We have noticed across our workforce, that internal pay rates have been edging up since early 2021, making recruiting in the US even more attractive due to the large gross margin potential.

SIA found that US staffing firms gross margin ranged from 15.3% to 41.7%, averaging at 25.6%. However, at PGC we have witnessed a steady uptick in margins in the US staffing industry, with some clients generating up to 45% in Q2 2021.

US Staffing Industry Forecast Beyond 2021

In light of record levels of job openings, the declining trend of initial jobless claims, and the phaseout of enhanced unemployment benefits across many states, the stage is set for continued expansion in the US staffing industry for 2022 and beyond. The global staffing industry is forecast to grow by 12% in 2021.

With the US securing the number one spot for global staffing revenue generated at present, the country is expected to hold on to its position as the largest staffing market in the world. Our US Staffing 2021 & 2022 - Temporary Trends to Watch ebook provides more detail on the most recent projections for the industry.

Considering Entering the US Staffing Industry?

If you want to gain a deeper insight into what is happening in the US staffing industry, you can book a strategy session with one of our experts.

Disclaimer: All information written here is for general informational purposes only and is not intended to be a substitute for professional and/or legal services.