US Staffing Industry 2023 in Review and Trends to Watch in 2024

Want access to the latest market insights? Smash 2024 in the US staffing market by downloading the latest projections and trends.

After the levels of unprecedented growth in the previous 24 months, 2023 was always set to an interesting year for the US Staffing Industry. In this blog, part-transcribed from the above episode of the Scale Up Stateside podcast, PGC’s US Expansion Experts present an in-depth analysis of the 2023 staffing industry and provide valuable insights into the trends that will shape the landscape in 2024.

Keep reading to discover:

US Staffing 2023 Industry Update

2023 US Staffing Industry Forecast

The US staffing industry is estimated to be worth $201.7 billion according to the latest update by Staffing Industry Analysts (SIA). This is a decrease of 10% from the record-breaking year of 2022.

Let’s set some context. Why has the US staffing market value declined?

Unsustainable US staffing industry growth in 2021 & 2022

First off, the decline in the US staffing industry revenue for 2023 is reasonable considering the record-breaking growth of 34% in 2021 and 20% in 2022. Despite the value receding, it is important to note that the industry is almost $50 billion larger than prior to the pandemic, which can be seen in the graph below.

Temporary job levels were at an all-time high in early 2022 (US Bureau of Labor Statistics), as economic growth was stimulated by government spending. These record levels simply proved unsustainable as economic baseline resumed.

A strong decrease in the medical sector skewed the average figure

Depending on what sector you recruit in, the US staffing industry decline for 2023 is more moderate, or in the case of some segments, doesn’t exist at all. Whilst the clerical, and life sciences segments are anticipated to decrease by 7% in 2023, the finance, and tech segments are expected to decrease by a more moderate 6% and 3% respectively.

The engineering segment within the US staffing industry is predicted to increase by 5% whilst the education segment is set to increase by a huge 20%. The overall market decrease is being driven by a 30% decline in the medical sector, particularly the travelling nurse segment which previously witnessed a sixfold increase in the previous four years. The exclusion of this segment implies a more moderate decline of 5.6% for the US staffing industry in 2023 (SIA).

Recession fears and working trends

Other macro factors played their role in forming the US staffing industry 2023 revenue projections. Recession fears led to a cooling of hiring in 2023, as many companies adopted a more cautious attitude. Moreover, as trends shifted back towards office working and more employers required their teams to return to the office, geographic constraints affected the supply of candidates.

US Staffing Industry Sector Performance in 2023

US Staffing Market 2023 Top Sectors Overview

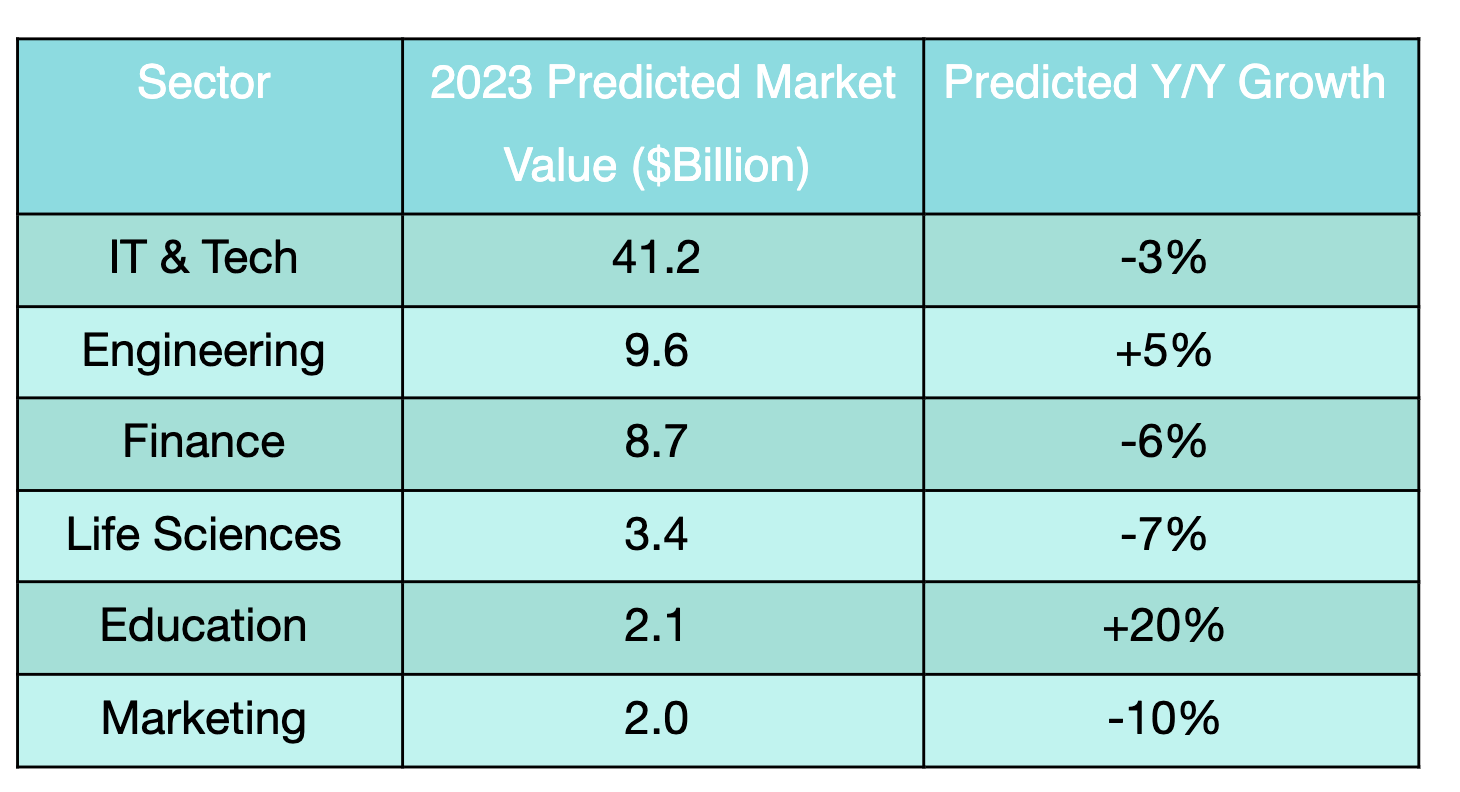

As mentioned above, many sectors within the US staffing industry such as tech, finance, life sciences, and marketing faced a moderate decline in 2023. However, this decline was not witnessed across the board as sectors such as engineering and education grew whilst the general market was reducing. A full breakdown of the size and performance of each of these temporary staffing sectors in 2023 can be seen below.

(Staffing Industry Analysts, 2023)

2024 US Staffing Industry Forecast

2024 US Staffing Industry Forecast

Turning our attention to 2024, SIA is projecting a 3% growth for the US staffing industry, predicting that the US market will be worth $207.2 billion, over 4 times more than the UK staffing market.

Within that US staffing industry 2024 growth, it is estimated that there will be 7% growth in the place and search segment and 5% on the temporary staffing segment. One of the things that many of PGC’s clients are surprised about when looking at the US market is how the total US market revenue is split up between permanent and contract segments. In 2024, it is estimated that the temporary (contract) segment will account for a whopping 89% of the entire US recruitment market.

A breakdown of the key growing sectors within this temporary segment can be seen below.

Growing Staffing Segments in 2024

Tech & IT

2024 Market Value = $43.2 Billion

Projected increase = 5%

IT makes up the largest share of professional temporary staffing revenue in the US. Tech and IT is the second-largest driver of the US economy, and the North American tech sector controls 35% of the global market. SIA forecast that the IT staffing segment will grow by 7% y/y in 2024 to reach a size of $43.2 billion.

Engineering

2024 Market Value = $10.4 Billion

Projected increase = 8%

Engineering is one of the few US staffing segments predicted to experience growth in 2023. This follows strong levels of growth in the previous two years, and you’ll not be shocked to hear that the engineering segment is expected to strengthen further in 2024 with growth of 8%, translating to a market value of $10.4 billion.

Legislation passed in the last three years has promoted the development of infrastructure and manufacturing, including the Infrastructure Investment and Jobs Act, the CHIPS Act, and more recently the Fiscal Responsibility Act which was signed into law by President Biden in June 2023. Projects supported by these bills will carry on or start next year and beyond, creating and sustaining demand for staffing agencies.

Finance/Accounting

2024 Market Value = $9.1 Billion

Projected increase = 4%

Similar to other US staffing segments, client caution and reduced hiring plans have led to a decrease in volume across the finance/accounting segment. Slight growth is projected for 2024, driven by improved volumes and pay rates. SIA speculate that potential new regulations related to the banking industry and cryptocurrency could spur the need for accounting and compliance projects requiring temporary workers.

Life Sciences

2024 Market Value = $3.5 Billion

Projected increase = 5%

Even though the life sciences sector in the US has seen recent layouts and volatility, a tight labour market remains for Life Science companies. This means that hiring continues to be a challenge, and staffing agencies that can provide a strong service will be seen as highly valuable. Salaries for the industry continue to grow (3%), though at a reduced pace in comparison to previous years. Staffing Industry Analysts have predicted a growth of 5% for this temporary staffing segment in 2024, marking its value at $3.5 billion.

Education

2024 Market Value = $2.2 Billion

Projected increase = 7%

The education temporary staffing sector is predicted to have witnessed a huge increase of 20% in 2023, with this upward trajectory looking set to continue in 2024. This is partly due to an increase in the number of contractors being used to fill a gap of permanent school teachers, but also an increased specialty by agencies in areas such as early childhood programs.

Marketing

2024 Market Value = $2.1 Billion

Projected increase = 5%

With caution arising around fears of recession, many companies reduced or in some cases halted advertising and marketing activity. This has resulted in the marketing staffing segment predicted to decline in 2023. However, as activity resumes heading into 2024, it is expected that this segment will witness a 5% increase equating to a market value of $2.1 billion.

According to Statista, digital advertising expenditure by US firms is expected to increase by 50% over the next four years, growing from $264 billion to $395 billion.

Furthermore, as per a report from Robert Half, 63% of marketing and creative managers planned to hire more contract professionals in the first half of 2023 – an increase from 44% for the second half of 2022.

This all points to a huge opportunity for staffing agencies to recruit within the marketing segment in the US.

Top Locations in the US for Staffing Agencies

Fastest Growing US Locations for Staffing Agencies in 2024

We regularly tell recruitment agencies moving into the US market that they should be niche in terms of what location to offer their services in. Given the sheer size of the US, it's important to be laser-focused when targeting a market, winning clients, and building relationships as aspects such as best-practice business development strategies can vary in different parts of the country.

The most popular states that we see businesses moving into are unsurprisingly those that generate the most revenue in the staffing industry. These are California, New York, and Texas. Each year, we produce a list of best-performing states based off our internal data.

Where are the Fastest Growing Locations for US staffing firms?

Looking ahead at projections for 2023, based off our internal data, California looks set to remain our most popular state for staffing firms to place contractors. New York looks set to regain 2nd position, overtaking Texas in 3rd place.

One of the strongest growing states we have witnessed in 2023 is North Carolina, which has witnessed an 11% increase in activity, rising it to 4th position on our list. We’ve previously spoken about the increase of staffing firms doing business in North Carolina, in popular areas such as Raleigh and Charlotte.

We have also seen a significant growth in contractor onboards in the following states:

Maryland (23%)

Illinois (17%)

South Carolina (7%)

Impact of Worker Migration to the South

US Domestic Migration to the South

The migration of talent to southern states has had a profound impact on the talent pool. It is important for agencies entering the US market to understand the implications and adapt their recruitment strategies accordingly to secure top talent.

The latest figures from the US Census Bureau demonstrates that between 2021 and 2022, five of the top six states for US state migration were all in the south-east of the country.

The big winners in terms of population growth were Florida, Texas, North Carolina, South Carolina, Tennessee, and Georgia. What are the common denominators among these states? Low to zero state income tax, warmer year-round weather, and more affordable cost of living.

In contrast, the top five states that lost the most population were traditionally five of the key states for the US economy: California, New York, Illinois, New Jersey, and Massachusetts.

These states benefitted hugely from the mass transit of people which translated to increased jobs for these regions assessing data from the US Bureau of Labor Statistics on employment levels between February 2020 and June 2023.

Florida saw growth of 7.3%, North Carolina increased employment by 6.3% whilst Tennessee experienced a 5.5% increase. In comparison, states in the north-east such as Vermont, Rhode Island, Maryland, Connecticut, and most notably New York all suffered decreased employment levels in the same time period.

Growth of the US Contingent Workforce

The Growing US Contingent Workforce

The US has the largest global contingent workforce in the world. It is estimated by SIA that there were 33 million contingent workers in the US in 2021, generating over $1.7 trillion in revenue.

The number of freelancers as a percentage of the total US workforce rose to an all-time high of 39% in 2022, according to the ‘Freelance Forward’ report released by talent platform Upwork Inc. In the report, more than half of freelancers provide knowledge services: 51% of all freelancers, or nearly 31 million professionals, provided knowledge services such as computer programming, marketing, IT and business consulting in 2022.

The contingent workforce in the US has been on an upward trend since 2020 after the labour market underwent extraordinary shifts, mainstreaming remote and flexible work. So much so, that by 2050, 50% of the US workforce is estimated to be made up of contingent workers according to a US Government Accountability Report, offering an extraordinary level of opportunity for recruitment firms in the US who source and place temporary and/or contract roles.

Over half of US companies are planning to increase hiring in H1 2024 with two thirds of employers planning to increase their use of contract professionals.

US Hiring Trends to Watch in 2024

US Hiring Trends to Watch in 2024

Increased pay transparency

Pay transparency will be a growing trend in the US, as more governmental bodies mandate it and more job seekers demand it. According to Robert Half research, 42% of workers expect to see a salary range in the job posting, and 57% would take themselves out of consideration if the employer doesn’t provide it upon request.

This is something that's becoming more and more prevalent among states in the US, in addition to provinces in Canada. As it is only likely to be a more common requirement, to ensure compliance, some national and global companies are taking the action to post a salary range in their job adverts regardless of location.

Hiring for growth

In 2024, the applicant pool in the US is likely to be somewhat larger, and that will bring with it an increased focus on hiring for long-term growth. This is concurrent with research from Robert Half where surveyed respondents cited company growth and employee turnover as the top reasons they need to add to their teams.

More gig workers

As established earlier in this piece, there is an upwards trajectory of US workers willing to accept temporary and temp-to-hire positions. Some see it as an opportunity to test-drive an employer before making the commitment to permanent employment. Others embrace gig work to gain flexibility in their work scheduling. This points to an increase potential for recruitment agencies to sell a contract solution to their end clients.

Worker classification

The coming year is likely to bring more attention to the issue of worker classification. Online staffing platforms that provide workers as 1099 independent contractors are undergoing greater scrutiny by governmental agencies. Engaging a compliance partner to help you compliantly payroll W-2 and independent contractors can help mitigate risks around misclassification.

Stay ahead of the game with insights from PGC's US expansion experts

Overall, as the global leader in terms revenue generation, the US market is in a very healthy state, particularly compared to pre-pandemic levels. Employment wise, the US had 4.7 million more jobs in November 2023 than February 2020.

We hope that the valuable insights shared by our US expansion experts have provided you with a clear understanding of the industry's current state and future opportunities for growth.

As you prepare for the year ahead, remember to keep an eye on the emerging trends discussed in this blog. By staying informed and adapting your strategies to meet evolving demands, you can position your agency for success in the highly competitive staffing market.

If you have any questions or need assistance with your US recruitment efforts, please reach out to our dedicated team. We are always ready to help you achieve your goals and thrive in the US market

Want more info? We sat down with Staffing Industry Analysts to assess the outlook for the US staffing market in 2024.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.