The 10 Best States for Business in 2024 [Infographic]

If you’re thinking about entering the US market or employing remote employees in other states, a data backed approach will help you be strategically placed to access your ideal target market and talent to build your US business. We know a thing or two about the best states for business from being a specialized US employer of record for over 24 years. This means we help businesses entering the US market to employ US workers on their behalf.

To help you out we’ve put together this heat map and blog to give you an idea the top states for growth in employee onboards from our clients in 2023, providing an indication of where the best states for business are in the US.

PGC Best States for Business 2024

1. California

Rank last year: #1

Benefits of doing business in California

California is number one in PGC’s best states for business for the third year in a row, after achieving the highest number of workers onboards by our clients in 2023. It seems like the living costs and taxes, heavy employment regulations, and high-profile companies like Tesla relocating from the state, haven’t deterred businesses from the Golden State. Why?

The most profitable US economy

If California was a country, it would be the fifth-largest economy in the world, larger than India, the United Kingdom, and France. yes, you read that right... Representing 15% of the US economy, makes it the largest state for generating income in the US. California produced more than $3.59 trillion of economic output in 2022.

It is important to look at GDP rates when choosing an area to do business in as high rates indicate a profitable economy, and California certainly paints a profitable picture for businesses.

Number one talent market for tech in the US

California is by far the most populous state in the US, home to over 39.1 million residents, a big contributor to why the state consistently ranks number one in terms of US employment numbers.

A considerable number of companies are hiring within California, proved by our own internal data, majorly due to the 1.8 million strong tech workforce based in the state. California leads globally within the tech industry as the largest US tech hub.

Home to the famous Silicon Valley; where Apple, Google and Facebook are based, California has more jobs in tech than any other state.

Standard of higher education in California

The standard of research at higher education institutions in California also contributes to the state's success in attracting international businesses entering the US market.

California has over 2.1 million students in the California Community Colleges, the largest higher education system in the US. Additionally, California strives to ensure the local workforce is prepared to keep businesses in the area competitive.

Highlighted via California’s new higher education commitment to provide first time students in the state two free years of community college .

Californian companies receive highest venture capital

California companies receive more venture capital investment than any other area in the US. Over 45% of all US venture capital raised in 2022 went to companies in California. In comparison, no other state received more than 13%.

Consider the price tag and strict employment laws that come with doing business in California

Yes our data shows California as one of the top states for business in regard to employee onboards. But we often don’t recommend the state when a company is first entering the US market due to the high costs of doing business. Less traditional states have climbed our rankings in previous years due to less strict employment laws, more business-friendly taxes and offering a lower cost of living. So, keep reading to find out the best states for business in 2024.

2. New York

Rank last year: #3

Benefits of Doing Business in New York

New York headlined high-profile news over the last few years due companies that fled the state during peak COVID-19 lockdowns. As a result, many questioned the necessity of conducting business in New York. Coupled with a rising popularity in businesses moving to Texas, New York was knocked down to third place in our list of best states for business in 2023.

However, the data shows that the state is recovering and many of our clients are still employing workers in New York. Subsequently, New York has returned to second place in our list of best states for business in 2024. We explore why, below.

The most connected US city

As we help companies from Europe and the UK enter the US market, New York is still one of the top states of choice when it comes to US business expansion, as it is one of the more straightforward locations to fly into.

New York City serves more international air travellers than any other area in the US, the most connected city in the US. This makes it perfect for business owners who need to travel both internationally and internally for business.

For example, business owners in the UK can catch a quick 7-hour flight to do business in New York City. Similarly, if you have an office in the UK or Europe, alongside operations in New York, the Eastern Standard time zone is very manageable, with a 5-hour difference.

New York has the third largest economy in the US

The GDP of New York State is worth over $2 trillion US dollars, the third-largest contributor towards the United States GDP in 2022. Considering the US has the largest gross domestic product globally, New York’s economy makes a significant contribution. If New York was a standalone country, its economy would be comparable to the likes of Canada and Italy.

New York also stands out for business as it is the financial and cultural capital of the world. Home to Wall Street and the United Nations headquarters, it has a significant influence on international affairs and setting global trends.

Whether you own a finance, fashion, or media business, you’re sure to find not only ready to buy clients in New York, but the best talent in your industry who want to ‘make it in NY.’

Additionally, there are 51 Fortune 500 companies headquartered in New York. This is a drop to number 2 from the number 1 position it held for years in the Forbes list for the most Fortune 500 companies per state, due to Texas’ growing popularity.

Some of the many internationally recognized employers still based in New York include PepsiCo, IBS, JPMorgan Chase, and American Express.

These multinationals lure ambitious professionals and graduates to the state every year. Companies often follow workers and there is nowhere better to look than New York for a diverse, highly educated, and large talent pool to choose from to grow business.

Taxes in New York

In terms of business friendliness, New York does not rank high. High operation costs in the form of tax rates, rent, living costs, and wages, contribute to the cost of doing business in New York. Tax rates in New York include:

Corporate income tax – 6.5-7.25%

Personal income tax – 4-10.9%

Combined state and local sales tax - 8.53%

New York’s high ranking in our list of best states for business can be contributed to the excellence of financial and tech talent in the state. To ease the burden of doing business in New York, It is worth noting that the state does offer small business owners several incentives and tax relief to ease the burden of doing business in New York. One program worth highlighting is START-UP NY, an incentive for new companies to locate on or near universities in New York to operate tax-free.

3. Texas

Rank last year: #2

Benefits of Doing Business in Texas

We talk a lot about Texas at PGC, mainly because we are living proof of one of the many companies that seized the benefits Texas has to offer and relocated to Austin during the pandemic peaks of 2021.

Although Texas has been overtaken by a strong recovering New York, the Lone Star State has gone from strength to strength, with PGC’s client’s employee onboards almost doubling in 2021, and that trend hasn’t stopped as more companies are choosing to do business in Texas.. So much so, that it knocked New York off the top spot of the most Fortune 500 companies in a single state, with 53 being based in Texas.

Texas has one of the lowest tax burdens in the US

One of the main reasons Texas ranks as one of the best states for business for companies entering the US market or expanding within is because it has one of the lowest tax burdens in the US. Businesses and employees can both benefit from more disposable income, thanks to the following tax rates:

Personal income tax – 0%

Corporate income tax – 0%

Combined state and local sales tax – 8.2%

However, it is important to note that Texas does charge a corporate franchise tax. This 6.25% state sales and use tax is imposed on all retail sales, leases and rentals of most goods, as well as taxable services. If you combine in local sales tax rates, the total combined sales tax rate can come to 8.2%.

Everything is bigger in Texas, including the talent

The saying is true, everything is bigger in Texas. Texas is the second-largest state in the US, nearly three times the size of the UK. The population size means leaves plenty of business and talent available.

Texas is home to over 170 colleges and universities, several of which rank highly as research institutions. A city worth highlighting is Austin which has become one of the main homes to tech companies globally.

As mentioned earlier, Texas recently knocked New York off the top spot of the most Fortune 500 companies in a state, with 53 based in Texas. If Texas is the number one state for Fortune 500 companies, then it is likely good enough for your business.

If you think Texas could be the state for your US business expansion, we have a blog on the 4 best cities in Texas for business which will help you choose the area for you.

4. North Carolina

Rank last year: #6

Benefits of Doing Business in North Carolina

We put North Carolina on our radar in 2022, after client employee onboards in the state increased by an impressive +381% year on year in 2021, jumping up 5 places. In 2023, the state ranked the 6th best state for business, moving up one space to overtake Massachusetts. This trending growth has continued as the state has now jumped up to 4th on our list of best states for business in 2024.

North Carolina, and in particular Charlotte, has become a destination of choice in the US due to the quality tech talent residing in the state and favourable tax incentives.

Taxes in North Carolina

North Carolina has gradually been reforming their tax code since 2013, when the state had a progressive income tax with a top rate of 7.75%. This was the highest personal income tax rate in the entire southeast at the time, but since it has dropped, with plans for decreases each year until after 2026. For Taxable Years beginning after 2026, the North Carolina individual income tax rate will be 3.99%. The 2023 tax rates in North Carolina include:

Individual income tax: 4.5% (decreased from 4.99% in 2022)

Corporate income tax: 2.5%

Combined state and local sales tax: 6.99%

Progressive plans are also in place to completely phase out corporation tax in North Carolina over the next decade from a bipartisan budget deal enacted in 2021. This will eventually make North Carolina the third state with no corporate income tax or business gross receipts tax, another main reason why it is one of our best states for business 2023.

Thriving Tech and Life Science Sectors in the ‘Research Triangle’

Raleigh is often the most sought-after area in North Carolina and is becoming one of the main east coast tech hubs of choice for companies entering the US market.

The Raleigh, Durham, and Chapel Hill area of North Carolina is named the ‘Research Triangle’ because of its proximity to three major research universities and has become a hub for technology and life science companies.

Furthermore, over 42% of North Carolina’s working population being college educated, has been a big pull for employers who want access to an educated workforce. Apple’s pledge to add 3,000 jobs in Raleigh by 2026 and invest $1 billion in the state is proof of the progressive tech hub forming in North Carolina.

Highlighting the popularity of the Life Sciences sector in North Carolina, Cushman & Wakefield, found:

There were over 790 life sciences companies in North Carolina.

634 of these life science companies were located in the Research Triangle region.

There is over 34.1K life sciences employment in North Carolina

Life science degree completions have increase by 39% from 2010 to 2020 to reach 3,013.

If you're interested in learning more, we highlighted in a blog why many of our clients have been asking themselves, ‘Next stop, North Carolina?’ It’s one to keep an eye on.

5. New Jersey

Rank last year: #5

Benefits of Doing Business in New Jersey

It’s no surprise New Jersey is one of PGC’s top states for business 2024. For the third year running it remains as the 5th most popular state for worker onboards by international businesses hiring in the US. We’re going to explore why.

Taxes in New Jersey

New Jersey has relatively high tax business rates; ranging from 6.5-9% for corporate income tax, a combined state and local sales tax of 6.6%. High earners will also have to dig deep when working in New Jersey due to the 10.75% top marginal individual income tax rate. This makes it the fourth highest in the US in 2023, according to analysis released by the Tax Foundation.

Despite the high tax rates and being in New York’s shadow (literally – You can easily view New Jersey’s skyline from Manhattan), New Jersey has everything a business needs to succeed in the US. The easy commute to New York is a main selling point of course, but the short ferry ride to Manhattan isn’t the only benefit of doing business in New Jersey.

Access to a large business and talent market

New Jersey is in the heart of the Northeast of the US, which is home to a large and affluent market. With easy access to major metropolitan areas such as New York City and Philadelphia, businesses in New Jersey have the potential to tap into significant talent and business networks.

New Jersey also has several airports, ports, and major highways, making it an ideal location for businesses that need to transport goods or travel frequently for business purposes.

Lower cost of living and rent than New York

Perhaps one of the main selling points of New Jersey is despite it having a high cost of living based on the US average, it is often more affordable for businesses than its neighbor state New York. This makes it a highly attractive option for businesses that want easy access to New York City, without the higher price tag.

New Jersey Business Funding

The New Jersey government has implemented an array of funding to help you start doing business in New Jersey over the last few years. Whether you require a loan to finance your US business expansion, are a startup looking for capital, or want to make the most of tax incentives for job creations, the states policies are designed to make it easier to grow a business. Some options (with eligibility criteria) include:

Angel Investor Tax Credit Program - Establishes refundable tax credits for investors in eligibile emerging technology businesses in New Jersey.

Aspire - A gap financing tool to support commercial, mixed-use, and residential real estate development projects.

Catalyst R&D Voucher Program - Supports New Jersey-based start up companies to accelerate the development and innovation of technologies.

Digital Media Tax Credit – A tax credit equal to 20-25% of qualified digital media production expenses to encourage companies to produce content in New Jersey.

Investments in Women-Led Start-ups – An investor network to increase available capital for female-led businesses in New Jersey.

NJ Accelerate - Incentivizes graduate companies to locate and grow in New Jersey, including a 1:1 matching loan funding up to $250,000 and rent support for up to 6 months for graduate companies

6. Florida

Rank last year: #4

Benefits of Doing Business in Florida

In 2021 and 2022 Florida hit the headlines as businesses fled traditionally popular states like New York to reap the benefits of the sunshine state. We witnessed the impact of this departure from 2020 to 2021, when the number of worker onboards within Florida from PGC’s clients experienced a 100% increase.

The trend towards hiring employees in Florida shows no signs of slowing down. In 2022, Florida overtook New Jersey as the 4th most popular state for worker onboards to PGC internal data. Reasons Florida is set to remain as one of the best states for business 2023 include:

Strategic location with world class transportation routes

If you want to have a global business an accessible area with efficient transportation routes should be at the top of your agenda when choosing an office location. Whether you must travel often for international or national client meetings, have numerous offices or need to ship or access goods, a connected location enables you to easily travel by land, sea, or air. Florida’s strategic location enables you to easily access the east coast of the US and provides a gateway to Latin America.

Florida Tax incentives

Florida boasts one of the lowest tax burdens in the US. Taxes in Florida include:

State individual income tax – 0%

Combined state and local sales tax – 7.02%

Corporate income tax – 5.5%

A bright lifestyle in the sunshine state

The clue is the nickname, ‘The sunshine state’. Florida boasts 237 average days of sunshine per year, triumphing over the US average of 205 days. This tropical lifestyle has attracted talent and businesses alike, not only this, but Florida has a relatively low cost of living.

We have a free eBook on the benefits and disadvantages of doing business in the two major cities in Florida, Miami and Tampa, if you would like to learn more about Florida.

7. Massachusetts

Rank last year: #7

Benefits of Doing Business in Massachusetts

Massachusetts has retained its status from last year as our 7th top state for business in 2024. Businesses, including the LEGO Group, who recently announced they plan to relocate its US HQ to Boston after 50 years in Connecticut, are increasingly choosing Boston as their home within the state - here are some reasons why.

Travel Faster in Boston - the closest US city to London

Boston spearheaded the way for accessible and fast transport in the US with the country’s first subway system. Boston’s public transport usage is the fourth highest in the US, with their historic system still effectively operating, making the city extremely convenient for commuters.

Businesses expanding to the US from the UK are sure to feel at home in Boston in comparison to other US cities, as it is deemed a ‘walkable’ city. It is much smaller geographically, making it more manageable for corporate travellers and those living in the city to travel around.

In addition to this, Boston is the closest US city for UK business owners traveling from London. This makes Massachusetts one of the best states for business when operating from the UK if you need to travel to the US frequently for meetings.

Taxes in Massachusetts

In 2022 Massachusetts brought in rule that incomes over $1 million will not be charged a personal income tax rate of 9%. For those below that threshold, the state charges a flat individual income tax of 5%, putting it in the lower half of the 50 states. Tax rates in Massachusetts include:

Corporate income tax – 8%

Individual income tax – 5-9%

Combined state and local sales tax - 6.25%

Access the best universities in the world in Massachusetts

Home to Harvard University, deemed the third best university in the world by Times Higher Education, Massachusetts has some of the best brains in business. Not to mention, the Massachusetts Institute of Technology which ranks number 5 in terms of top universities globally... No wonder huge companies like Liberty Mutual, Staples, and General Electric are headquartered in the state.

Here are more reasons why doing business in Massachusetts is a good idea.

8. Pennsylvania

Rank last year: #9

Benefits of Doing Business in Pennsylvania

Pennsylvania climbed one place to number 8 for PGC contractor onboards. Pennsylvania is still chosen by many businesses entering the US market thanks to its strategic location in the heart of the East Coast. Here are some other reasons why companies choose to do business in Pennsylvania. \

A globally competitive economy in Pennsylvania

Pennsylvania would have the 19th largest economy in the world if ranked as a country and ranks 6th in the US. Home to 24 fortune 500 companies, the high calibre of higher education institutions based in the state, ensures the talent pool does not dry up for companies requiring highly educated talent.

Taxes in Pennsylvania

Pennsylvania’s tax system ranks 33rd overall on our 2023 State Business Tax Climate Index. Taxes to pay when doing business in Pennsylvania include:

Corporate income tax – Flat rate of 8.49%

Combined state and local sales tax – 6.34%

Individual income tax – 3.07%

Pennsylvania is located next to business powerhouse states

Located halfway between New York City and Washington, DC, you can easily reach these business powerhouse states via a quick drive or flight, while taking advantage of one of the lowest costs of living in the Northeast.

With the 6 international airports, 8 foreign trade zones, and 3 ports providing access to the Gulf of Mexico and the Atlantic Ocean, companies have confidence in the ability to trade and compete internationally when based in Pennsylvania.

A ‘One-Stop Shop’ for developing business

Companies based in Pennsylvania can benefit from the business incentives they have to offer. Some incentives on offer include:

The Pennsylvania First Program - Grants or loans at a maximum of $5,000 per job for large-scale competitive “targeted industry” projects that inject significant capital investment in PennsylavaniaPennsylvania.

Pennsylvania Industrial Development Authority (PIDA) Loan: Businesses that commit to creating or retaining jobs in Pennsylvania may qualify for low-interest loans up to $2.25 million to contribute towards financing eligible project expenditures.

Job Creation Tax Credit (JCTC) - Businesses that create at least 25 new jobs in Pennsylvania or grow current employment by 20% are eligible for a corporate income tax credit of $1,000 per year (up to 3 years) for each new job created.

A significant government support resource worth highlighting is the Pennsylvania Business One-Stop Shop. Launched in 2018, this serves as a guide to help businesses at all stages of development in the state and connect them with all the resources they need. Their team can help you with:

Planning - Anything from business advice, writing a business plan, and choosing your structure.

Registering your business in Pennsylvania

Operations - Hiring workers in Pennsylvania and state taxes.

Growing - Business resources and state funding.

9. Illinois

Rank last year: #10

Benefits of Doing Business in Illinois

Despite Illinois being one of the top 3 states people are leaving in the US, due to tax rates and the state’s fiscal strain, Illinois is still in our list of best states for business, even climbing one place this year according to our internal data. Why?

Illinois joined 5 states crossing the $1 trillion GDP threshold

Illinois still ranks within the top 10 states for PGC employee onboards largely because it is the fifth largest economy in the US. Illinois is the fifth state to top $1 trillion in annualized GDP, joining California, Texas, New York and Florida as one of the highest grossing states for business in 2024.

Chicago is the main economic powerhouse contributing towards Illinois’ economic output and would rank 21st in the US if the city was a state. Chicago’s economy alone is bigger than many countries, which is a key indicator of the strength of the area for business.

Taxes in Illinois

Illinois has flat income tax rate system and a personal income tax rate that doesn’t seem as steep as other high-profile states. Tax rates in Illinois include:

Individual income tax: 4.95%

Corporate income tax: 9.5%

Combined state and local sales tax: 8.85%

Chicago is the third largest metro area in the US

The city of Chicago in Illinois is the third-largest metropolitan area in the US, providing companies with a plentiful supply of customers and employees. Chicago is centrally located in the US and connects to almost every major city across the US and internationally. If you need to travel frequently for business, Illinois could be the destination for you.

Business Incentives in Illinois

A competitive range of business incentives is available to companies expanding to Illinois. Loans and grants businesses can avail of include assistance with equipment, working capital, tax credits and exemptions, and land acquisition.

10. Georgia

Rank last year: #8

Benefits of Doing Business in Georgia

Although Georgia has dropped two places on our best states for business list from last year, Georgia has retained its spot of our list of best states for business in 2024.

Georgia historically experienced a booming 258% increase year on year in PGC worker onboards in 2021, and remains within the top 10 best states for business by PGC clients. So why are more businesses expanding to or hiring employees in Georgia?

Business incentives in Georgia

The favourable business climate and government commitment to strengthening local workers’ skills and companies' development is just few of the many reasons that landed Georgia the number 1 spot for business from 2013 - 2022 by Site Selection. Taxes in Georgia include:

Corporate state tax - 5.75%, after being lowered from 6% in 2019.

Combined state and local sales tax – 7.40%

Individual income tax – 5.49%

The Georgia Department of Economic Development helps businesses grow within the state, with project managers located in all 12 regions. The project managers are available for consultancy services including:

Help with international trade to reach global markets

Tax credits and exemptions to reward growth

Research and market information to guide decision making.

Georgia’s youthful skilled workforce

Companies in Georgia have access to a large talent pool due the state having the 8th largest population in the US. The state has low unionization and at-will employment so for companies that need contractors for short term projects with quick turnaround times, Georgia’s employment laws allow things to move fast, making it one of the most business friendly states in the US.

The median age of Georgia’s working population is lower than the US average at 36, with Atlanta being a top 5 market for millennials. With a steady stream of graduates hailing from universities in the area, and home to over 52,000 software developers, information analysts, and 44,000 plus engineers, Georgia is especially appealing to tech companies.

Coca-Cola, The Home Depot, and Delta Air Lines, are some of the 18 fortune 500 companies headquarters based in Georgia.

Georgia’s commitment to workforce development

Additionally, Georgia’s commitment to developing the local workforce is clear through their internationally acclaimed workforce training program - Georgia Quick Start.

The program provides free customized workforce training to qualified new, expanding, or locally based businesses to help them compete in the global economy. The large skilled workforce and quick start program is a win-win for companies hoping to grow by expanding to Georgia.

Reach global and US markets easily in Georgia

Georgia’s convenient location has bolstered its ranking as one of PGC’s top states for business 2024. Domestically, companies in Georgia can access 80% of the US market within a two-hour flight time or two-day drive. For this reason alone, it is little wonder that UPS are headquartered in Atlanta.

The location also enables companies to serve the ever more popular south-east United States, world-class ports and airports mean that global markets can be reached with ease.

If you want to learn more about why Geogia is rapidly becoming a state of choice for businesses entering the US market, we wrote a more detailed blog on why Georgia is an attractive state for doing business.

Emerging Trends for the Best States for Business 2024

Growing Popularity of South Atlantic States

Growing Popularity of South Atlantic States

The South Atlantic states have seen a notable surge in their popularity as top locations for businesses in the aftermath of COVID-19. This region, which includes Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and West Virginia, has become increasingly attractive to businesses of all sizes, from startups to multinational corporations.

This increase in popularity is witnessed in our data with 3 South Atlantic States occupying our top 10 list, and North Carolina surging from 6th place to 4th place. Outside of the top 10, we also see growth in contractor onboards in the states of Maryland and South Carolina. Furthermore, Delaware remains as the most popular states for US businesses to incorporate, with a whopping 67.8% of Fortune 500 companies registered there.

One of the primary drivers of this influx has been the competitive economic landscape that the South Atlantic states offer. Many of these states boast lower corporate tax rates and provide generous incentives for businesses to establish or expand their operations.

The quality of life in the South Atlantic region is a compelling draw for businesses and their employees alike. The area is known for its mild climate, diverse cultural offerings, and access to both the Atlantic coastline and mountainous landscapes, providing a balance between work and leisure that is increasingly valued in today's business world. This has become especially pertinent in the wake of COVID-19, as the pandemic has shifted priorities for many individuals and companies.

The significant net domestic migration into the South Atlantic states post-COVID-19 is both a cause and effect of their growing appeal as business destinations. This has created a self-reinforcing cycle, attracting even more businesses who want to source great talent.

With their strategic location, offering easy access to domestic and international markets, and ongoing investments in infrastructure, the South Atlantic states are poised to remain a regular fixture in our list of best states for business.

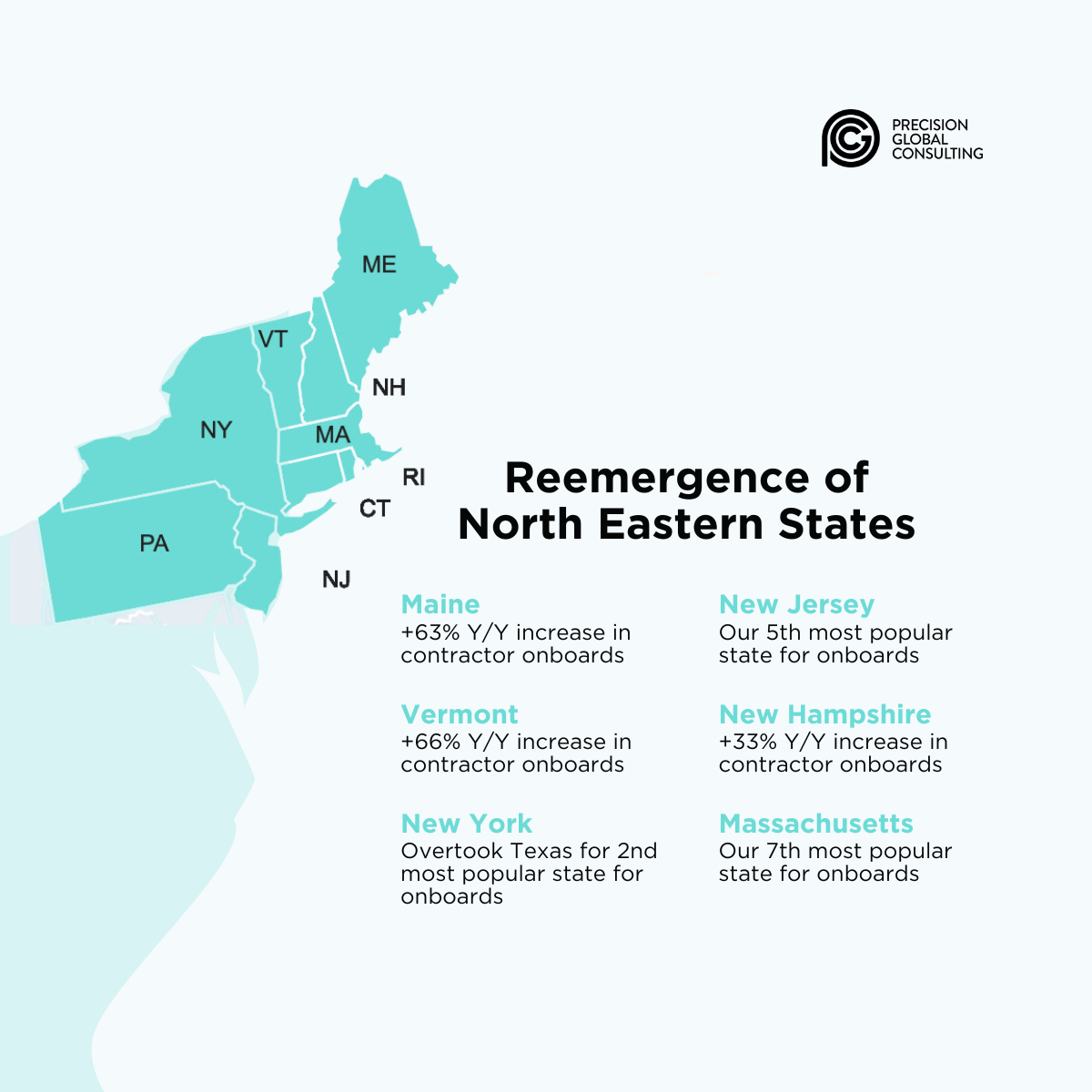

Reemergence of North-Eastern States

Reemergence of North-Eastern States

The reemergence of North-Eastern states as popular locations for businesses marks a significant turnaround from the trends observed in the aftermath of the COVID-19 pandemic. During the pandemic, these states experienced substantial net domestic migration outflows, as businesses and individuals moved to states with lower costs of living, less stringent regulations, and more favourable climates.

However, our data appears to show a re-emergence of this area, with states demonstrating growth in 2023. As noted earlier, New York reclaimed second place from Texas in our list of best states to do business in. Similar to the South Atlantic, 3 states from the North-East occupy our list. Meanwhile, Maine, Vermont, and New Hampshire all witnessed growth outside of the top 10.

The North-East remains a strategic location along the Eastern seaboard offering access to some of the largest markets in the United States and Canada. As working trends have changed over these last few years, some employers are now skewing away from remote work, which may be a factor in the resurgence of these states. However, these states have also developed initiatives to help attract those who still wish to work remotely; Vermont’s Remote Worker Grant Program offers an example of this

The North-Eastern states are well-positioned to solidify their status in our list of best states for business in the United States.

Ready to Select a State to do Business in?

When entering the US market or relocating states, it is important to remember that each state varies in terms employment laws, time zones, taxes, minimum wages, sector demand, culture, living costs, and much more. To ensure you are best positioned to grow your business in the US, complete market research before deciding which state will best support your requirements.

The above states aren’t an overall reflection of the workforce in the US, but a high-level view of PGC’s workforce. If you want to expand your business into or within the US, we can help you choose the best states for employing within your sector, and ensure you remain compliant when hiring US employees. Book a free US opportunity session to find out how you can easily start doing business in the US.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.